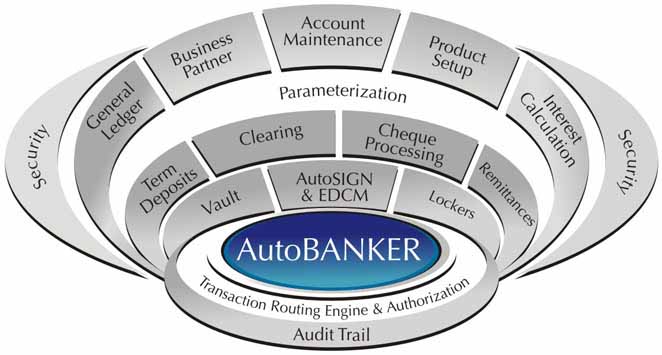

AutoBANKER - Core Banking System

AutoBANKER is a global banking system catering to the requirements of any financial institution, providing online, real time synchronized banking business automation. The system empowers banks to continuously enhance their business by leveraging agile, new generation technologies. Via its customizable parameter setup, it allows for dynamic, reliable and scalable product transformations in line with new practices and procedures.

The end-to-end AutoBANKER product suite caters for core banking, treasury, trade finance, consumer and corporate lending, electronic delivery channels and additional administrative modules in a seamlessly integrated manner. The system has been designed and developed through years of experience and interaction with global banks and offers several powerful and differentiating features making it one of the most comprehensive, flexible and scalable solutions in its class.

The salient features of system are:

- User friendly screens

- Entirely parameter driven

- Advanced Security mechanism

- Modular architecture

- Easy integration with middleware and backend systems

- On-line Real time Balance updating

AutoBANKER’s functionality includes:

- General Ledger

- Business partner management system

- Account maintenance

- Product setup

- Interest calculation

- Term deposit

- Clearing

- Cheque processing

- AutoREMIT – remittance management system

- Document Management System

- Vault management system

- AutoLOCKER – locker management system

- AutoSIGN and EDCM – electronic document management

- Transaction routing and authorization

- Complete audit trail

The principal design features of the system are:

On-line real time processing -Â This feature enables all entries, including transactions and parameter maintenance, to be validated and processed online with real-time updating of the database. It ensures that the system provides current information at all times.

Customizable user friendly menu driven interface -Â This feature enables clients to navigate through different menus to access particular functions. Moreover, it contains an option enabling clients to customize the menu contents and error messages. Information alerts on different codes used within the application are also available on relevant stages.

Parameters -Â The system is totally parameterized with over 90% of processing being parameter driven including chart of accounts, product setup, schedule of charges and module specific parameters.

Information retrieval and report generation -Â This function ensures efficient retrieval of information and reporting to the bank’s customers and management. The system also provides financial reports including balance sheets, customer ledger reports, daily product calculation reports and account activity reports.

Security -Â The system is highly security driven incorporating the following security controls:

Operational controls refer to the security services required to maintain integrity and availability of data across the application

- Account balance integrity

- Account number check digits

- Security key

- Start of day, end of day operations

- Backup, restore and disaster recovery procedures

Application level security refers to those security services pertaining to users of the application and is invoked on the interface between the application and the application server to which it is connected

- Password security

- Password length

- Password expiry

- Password reset

- Invalid login attempts

- Password change history

- Password change history

- Password encryption

- User level security

- User roles

- Menu, tab and report rights

- Transaction and authorization limits

- User expiry

- Inoperative days

- User status

Database level security refers to the system, processes, and procedures that protect the database from unintended activity.

- Access control and authentication

- Auditing

- Data encryption

Audit Trail -Â For each login the IP address of the user machine is stored in the user session. The system facilitates enabling/blocking of users based upon their IP addresses. The session information contains information of the user (ID/name) and all activities can be tracked and monitored through the session ID. Complete audit trails and logs are available with the help of session management which enables the bank to carry out following tasks:

Audit trail through session ID

- Auto log for errors and notification (Separate log for errors are maintained and audit trail of all activities is maintained in the system at both the application and DB server level)

- Logs for event occurrence

- Logs for transactions

- Financial transactions

- Non-financial transactions

- Inquiries

- Log recording support on multiple machines (trigger based)

- Setting logs or notification priorities

- Support for archival of logs

Centralized audit facility

- Maintenance of complete logs on the central server

- Maintenance of logs on client side in the form of files just like cookies etc.

- Ability to run queries on logs